OR Heirship Affidavit free printable template

Fill out, sign, and share forms from a single PDF platform

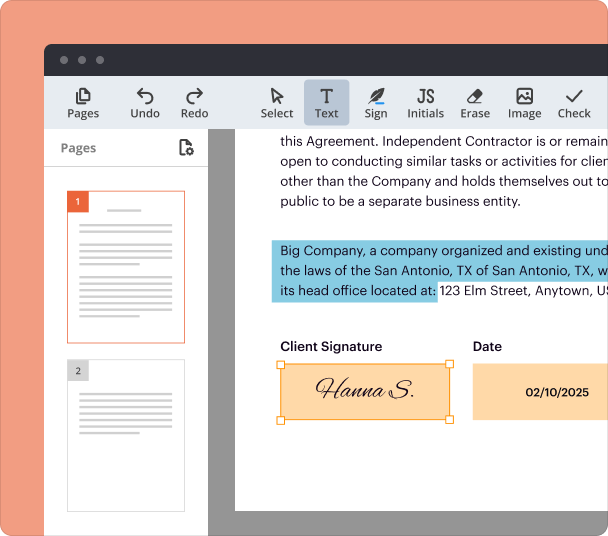

Edit and sign in one place

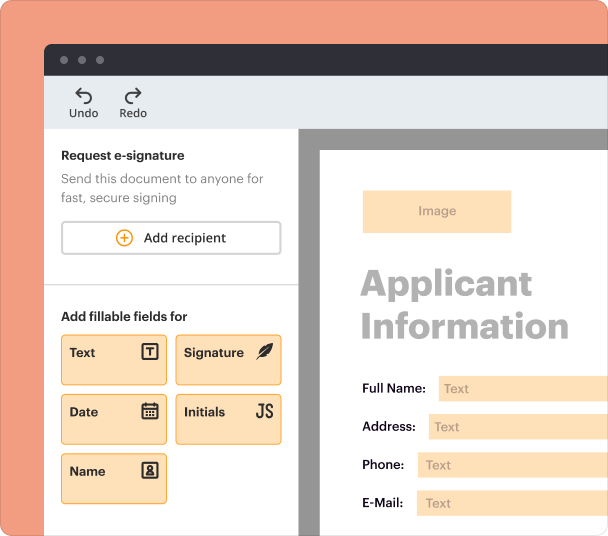

Create professional forms

Simplify data collection

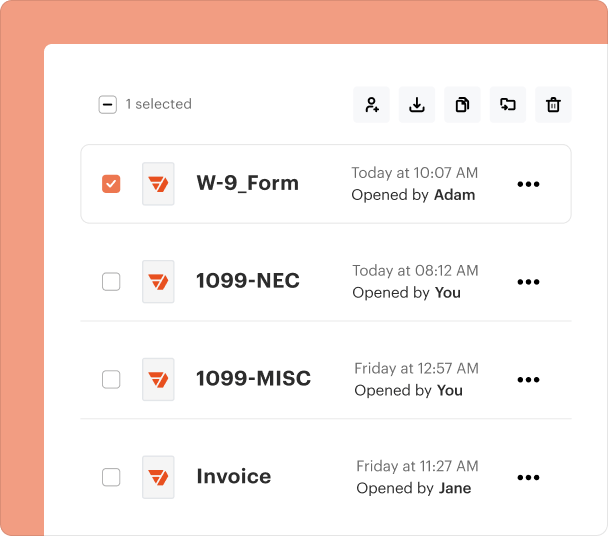

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out an heirship affidavit printable form in Oregon

Filling out an heirship affidavit is crucial for establishing the rights of heirs to an estate when a decedent has not left behind a last will and testament. This document serves as a legal statement that identifies rightful heirs based on the decedent’s family history. In Oregon, a printable form of this affidavit is readily available, making it accessible for individuals navigating the complexities of probate and inheritance.

Understanding the heirship affidavit

An heirship affidavit is a legal document that outlines who the heirs of a decedent are. This affidavit holds significant importance in probate law, as it facilitates the transfer of assets when no will exists. In Oregon, specific legal requirements govern its execution, ensuring that the affidavit is both valid and recognized by the court.

-

It is a sworn statement confirming the identities of heirs of a deceased person.

-

This document aids in the distribution of assets where no will is present.

-

Oregon emphasizes notarization and specific content detail to validate the affidavit.

What details are required in the heirship affidavit?

Completing the heirship affidavit necessitates specific information about both the affiant and the deceased. The affidavit should include precise details that confirm the affiant’s knowledge of the decedent’s familial relations.

-

This is necessary to establish credibility and authority in making the claim.

-

This helps in identifying the estate accurately during probate.

-

The affiant must demonstrate familiarity with the decedent’s familial ties.

-

These questions help clarify the context surrounding the estate.

How do fill out the heirship affidavit?

Filling out the heirship affidavit involves a systematic approach to ensure accuracy. Start by gathering the necessary details before entering them into the form.

-

Make sure all details about yourself and the decedent are complete and correct.

-

Fill in the required sections with accurate information and consult templates if available.

-

Ensure to have the affidavit notarized to validate the document's legal standing.

-

File the affidavit with the appropriate county office in Oregon to register the heirs officially.

What legal considerations should be aware of?

In Oregon, understanding inheritance laws is key when filing an heirship affidavit. Various state laws dictate how heirs are identified and the legal implications of the affidavit.

-

These laws govern how estates are distributed in the absence of a will, impacting who can claim inheritance.

-

Oregon recognizes specific familial relationships in identifying heirs, which must be documented.

-

Oregon law typically requires notarization to ensure the affiant’s identity and intention are verified.

-

Engaging with probate attorneys can provide clarity and security to the process.

How can pdfFiller assist with managing your heirship affidavit?

pdfFiller offers a streamlined solution for managing your heirship affidavit. By utilizing their platform, you can access various editable PDF templates, allowing for easy completion and management of your documents.

-

Search for the heirship affidavit template directly on the pdfFiller platform.

-

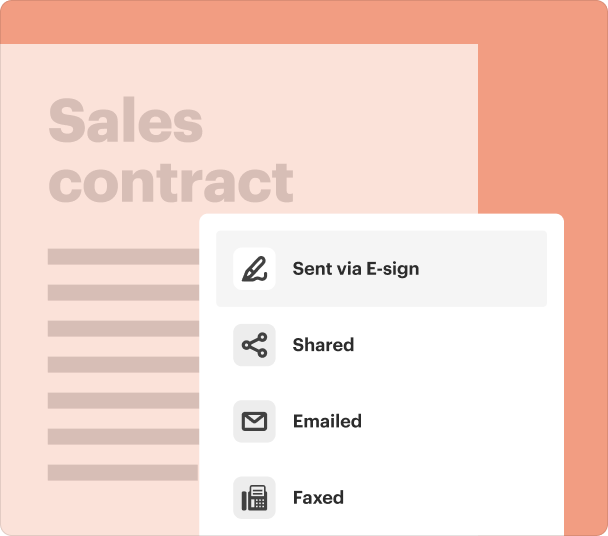

Leverage eSigning to expedite the signing process and collaborate with other parties involved.

-

Benefit from cloud storage which ensures document safety and accessibility.

-

Access your documents anytime, anywhere—ideal for those managing time-sensitive matters.

What common mistakes should avoid?

It is essential to be meticulous when completing the heirship affidavit to avoid common pitfalls that can delay the process.

-

Any missing details might render the affidavit invalid.

-

Providing incorrect information could lead to legal disputes or rejections.

-

A lack of notarization can undermine the affidavit's legitimacy.

-

Make sure to submit the affidavit to the correct office to ensure it is legally recognized.

What steps should take after filing an heirship affidavit?

After successfully filing the heirship affidavit, there are critical follow-up steps to ensure everything is in order.

-

Keep copies and document any communication with the probate court.

-

Notify banks, asset holders, and other related entities of the affidavit findings.

-

Familiarize yourself with Oregon's timelines to efficiently manage your responsibilities.

Frequently Asked Questions about affidavit of heirship form

What is an heirship affidavit?

An heirship affidavit is a legal declaration that specifies who are the rightful heirs of a deceased person's estate. It is particularly used when there is no will and provides a structured way to identify heirs under the law.

Do I need an attorney to fill out the heirship affidavit?

While you can complete the heirship affidavit on your own, consulting with a probate attorney is advisable. They can provide clarity on legal requirements and help ensure that the document is executed correctly.

Can I use a printable form for the heirship affidavit?

Yes, you can find printable forms for the heirship affidavit online. Ensure you are using the most current version as per Oregon’s legal requirements.

What happens if I make a mistake on the affidavit?

Errors in the affidavit can lead to complications in probate proceedings. Depending on the mistake, you may need to rectify it by filing an amended affidavit.

How long does it take to process an heirship affidavit?

The processing time for an heirship affidavit can vary by county in Oregon. Generally, once filed, it can take several weeks to be acknowledged, depending on the court's workload.

pdfFiller scores top ratings on review platforms